MASSACHUSETTS IS ALREADY BRACING for significant health care disruptions stemming from Republicans’ sweeping tax bill that cuts Medicaid funding, and policymakers are worried that even more residents will soon feel added strain because of federal inaction.

A pandemic-era tax credit that has helped millions of Americans pay for health insurance is set to expire at the end of the year. Many Democrats, joined by state marketplace administrators and activists, are mounting an all-out blitz in support of extending the Biden-era aid as the threat of a federal government shutdown fast approaches.

But Republicans who control Congress so far have not indicated they plan to extend the so-called “enhanced premium tax credits,” at least not as part of a funding bill to keep government open past September 30. That deadline might be the last, best chance for supporters to get the tax credits renewed.

Without action, Massachusetts health care leaders and advocates warn the impacts could be dire. Hundreds of thousands of Bay Staters could face higher health insurance premiums next year. Some might need to pay more than three times as much to maintain roughly the same level of coverage. State budget-writers could wind up with a quarter-billion-dollar headache, too.

“This feels like it would be a real gut punch to working families across the state if this was to be rolled back,” said Alex Sheff, senior director of policy and government relations for the advocacy group Health Care for All.

Officials at the Massachusetts Health Connector, the state’s health insurance marketplace, estimate that more than 337,000 residents will experience higher costs if Congress allows the credits to expire. The annual tax credit loss in Massachusetts for residents would amount to $425 million, or an average of $1,364 per person, according to a fact sheet the Connector began circulating this month as its leaders pressed for action.

The federal tax credits not only helped Massachusetts residents afford health care, but they shifted some of the financial burden from the state, freeing up funding to expand subsidies to a larger swath of people who need help. If policymakers want to keep the lowest-cost plans available to Massachusetts consumers at roughly similar rates, they might need to kick in hundreds of millions more in state funding to make up for lost federal dollars.

State officials have spent recent weeks notifying residents that they might lose significant subsidies, and face greater expenses, if the program sunsets.

“Letting people know the prospect that their ability to continue to afford coverage is in question as a result of congressional inaction so far is a worrying place to be in as a marketplace,” said Connector executive director Audrey Morse Gasteier. “The clock is really ticking.”

Sheff said without the tax credits, about 26,000 Connector members will likely see a “very dramatic” increase in their out-of-pocket costs for health coverage, and more than 300,000 others will experience “some increase in their premiums.”

Some of the broader impacts could be a spillover. If younger, healthier people decide to drop coverage altogether because of the price increase, the remaining membership becomes, on average, older and sicker — populations that have higher insurance costs.

“Even if you weren’t receiving a premium tax credit, your premiums are going to go up as a result of this,” Sheff said.

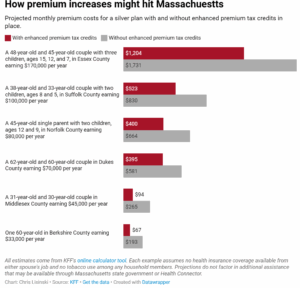

The credits cap out-of-pocket premiums at up to 8.5 percent of a household’s income, depending on how much they earn. As a result, there’s a wide range of potential cost impacts that could result from the expiration depending on a family’s size, income, and other factors.

Health policy nonprofit KFF published a calculator tool that allows users to see an estimate of what they might need to pay with and without the enhanced premium tax credits in place.

Financial upheaval could stretch beyond consumers. Officials aim to keep ConnectorCare premiums low, and for the past four years, they’ve used the enhanced premium tax credits to offset the costs of doing so. If the credits evaporate, the state itself would need to find $255 million to keep the highly subsidized premiums at current levels.

It’s not clear if the Legislature would support that extra funding injection at a time when budget-writers are struggling with other challenges, some inflicted by previously enacted federal funding cuts.

The end of the enhanced tax credits would also reduce federal dollars that were partly funding a pilot program state lawmakers and Gov. Maura Healey created to make more people eligible for ConnectorCare.

Because of the savings the tax credits afforded Massachusetts, Beacon Hill temporarily expanded eligibility for ConnectorCare, which provides low-cost health plans, from 300 percent of the federal poverty level to 500 percent, through 2026.

But if the tax credits expire, Bay Staters in the 400 percent to 500 percent FPL bracket — equivalent to an annual income between $128,600 and $160,750 for a family of four — would no longer qualify. Morse Gasteier said that includes about 19,000 people.

Right now, with enhanced tax credits in place, consumers in that range pay a minimum premium of $274 per month for ConnectorCare coverage. If the credits evaporate, they would need to pay at least $1,100 per month in premiums for a roughly equivalent plan with similarly low copays and cost-sharing, according to Sheff.

He stressed it’s “unlikely” that consumers will absorb those costs. Most will instead downgrade to a lower-tier plan with less owed in monthly premiums but higher copays and deductibles.

Sheff said even someone who shifts to a mid-tier plan might still owe premiums “more than double” what they pay for ConnectorCare.

The credits first launched in 2021 as part of the American Rescue Plan Act, and Congress extended them through the end of 2025 as part of the Inflation Reduction Act. Millions of Americans now use the credits to offset their health insurance costs, including close to four in five Bay Staters who get coverage through the Connector.

Hannah Frigand, Health Care for All’s senior director of help line and public programs, said she regularly receives calls from Bay Staters who are able to use savings generated by the tax credit to pay for food, rent, and other basic necessities.

“It’s very worrisome to think about the situation that people will be in if these tax credits go away,” she said.

Although the sunset date is the end of the year, extension supporters argue that the inflection point will arrive much sooner.

Open enrollment begins on November 1, at which point consumers will be able to shop around and compare plans. Morse Gasteier wants resolution before then so enrollees can get a clear estimate of next year’s costs, rather than make decisions based on projected massive costs.

“Once you lose people by presenting sticker shock to them about what their health coverage costs will be, it’s very difficult to get them back,” Morse Gasteier said.

“Just because you could make this decision closer to December 31 doesn’t mean that there’s not damage done by people getting scared away by really high health care costs,” she added.

Some marketplace leaders have been pushing for Congress to act by September 30 to avoid any spillover into open enrollment.

That’s also the end of the federal fiscal year and the date by which Congress and President Trump need to agree on a funding deal to avert a government shutdown.

The credits appear to be a sticking point in increasingly tense talks in Washington, DC.

US Rep. Lori Trahan said she and fellow Democrats plan to use the government funding debate as leverage to push Republicans, who narrowly control both branches of Congress, to extend the tax credits.

“We’ve made it very clear that the Republicans need Democratic votes in order to pass a [continuing resolution] and their appropriations bills, and we aren’t going to stand for ripping health care away from millions of people and rubber-stamp a budget that does that,” Trahan told CommonWealth Beacon.

GOP leaders have suggested Congress can wait until after the end-of-month deadline to decide the fate of the enhanced credits.

“I think that we are open to the conversation about what we do with the Obamacare premium tax credits,” Senate Majority Leader John Thune said earlier this month, according to NBC News. “That’s something in which members, Republican senators and I think, for that matter, Republican House members have an interest, as well, but this isn’t the place to do that.”

Some congressional Republicans have suggested any potential agreement on extending the aid should consider reforms to the program to prevent “fraud,” Axios reported.

Healey and 17 other governors, all Democrats, wrote to congressional leaders last week urging prompt action to extend the tax credits, calling it “one of the simplest, most effective steps Congress can take to keep health care affordable.”

“If they expire, premiums will rise by thousands of dollars for many families, millions will lose coverage, and people will be forced to make impossible choices between paying for health care, rent, or groceries,” they wrote. “Hard-working American families, older Americans not yet on Medicare, small business owners, and rural communities — where marketplace coverage is often the only option — will be hit the hardest.”

Even if Congress winds up embracing the program, leaders at the Connector are bracing for a challenging open enrollment period marked by disruption.

The federal reconciliation package sometimes referred to as the “One Big Beautiful Bill Act” dramatically overhauled health care spending and eligibility. Altogether, the new law could force about 80,000 Connector members — about one-quarter of the current pool — to lose coverage, according to the Massachusetts Taxpayers Foundation.

“This,” Morse Gasteier said, “is really the most complicated open enrollment period we’ve prepared for probably in a decade.”

Find the article here.